Mera Ghar Mera Ashiana Scheme 2025

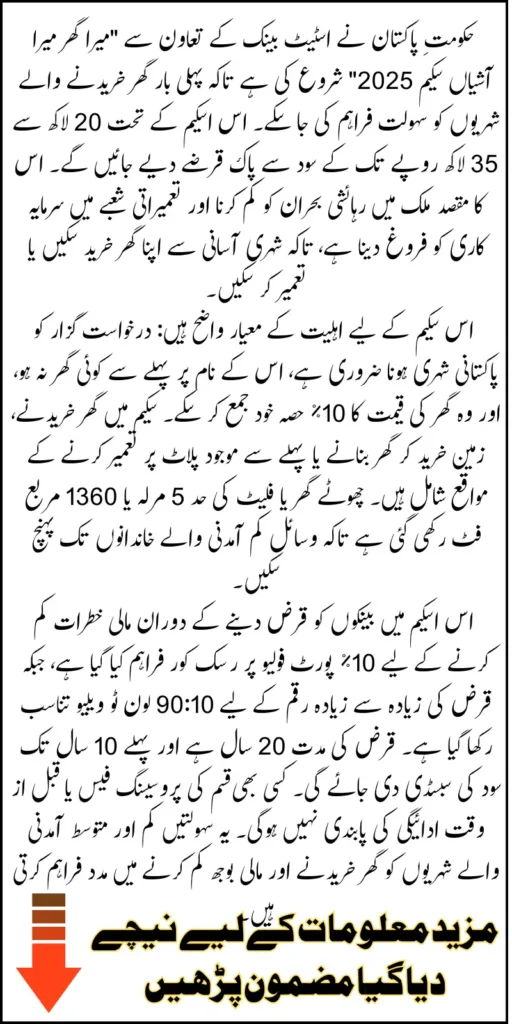

Mera Ghar Mera Ashiana Scheme 2025: The Government of Pakistan, in collaboration with the State Bank of Pakistan, has introduced an ambitious initiative called the Mera Ghar Mera Ashiana Scheme 2025. This scheme is designed to make homeownership accessible for first-time buyers by offering interest-free home loans ranging from 20 to 35 lakh. The initiative aims to address the housing shortage in the country while supporting economic growth by encouraging investment in the housing sector. The scheme is tailored to help citizens purchase, construct, or expand housing units while keeping financial burdens manageable.

With the rising cost of housing, owning a home has become a challenge for many Pakistani families. This scheme ensures that eligible citizens can achieve the dream of homeownership without paying interest for a significant portion of the loan term. By promoting affordable housing, the government hopes to increase living standards, boost the construction industry, and create employment opportunities for skilled and unskilled laborers across the country.

Eligibility Criteria for Mera Ghar Mera Ashiana Scheme

The scheme is specifically designed for first-time homeowners in Pakistan. To qualify for this program, applicants must meet certain eligibility criteria:

- Must be a citizen of Pakistan holding a valid CNIC

- Should not already own any housing unit in their name

- Must demonstrate the ability to contribute 10% equity toward the home purchase or construction

The eligibility requirements are straightforward to ensure that the benefits of the scheme reach those who genuinely need support. By targeting first-time homeowners, the scheme prioritizes citizens who are financially disadvantaged and are struggling to enter the housing market. This approach ensures that the program promotes equitable access to housing across urban and rural areas of Pakistan.

Scope of the Scheme

The Mera Ghar Mera Ashiana Scheme provides multiple options for homeowners to utilize the offered loans:

- Purchase of a house or apartment

- Construction of a house on an already owned plot

- Purchase of a plot and subsequent construction of a house

This flexibility ensures that the scheme caters to different housing needs and financial capacities. Citizens can either buy ready-made homes or build new houses according to their preferences and budget. By allowing multiple avenues for housing acquisition, the government ensures that the scheme remains inclusive and adaptable to various socio-economic backgrounds.

Also Read: Punjab Assan Karobar Finance Scheme Phase 2 Has Been Started By Maryam Nawaz Know Full Details

Size and Type of Housing Units Covered

The scheme places certain limits on the size of housing units to keep the focus on affordable housing:

- House up to 5 Marla in size

- Flat or apartment with an area of up to 1360 square feet

These limits ensure that the program targets low to middle-income families and avoids diverting resources to luxury housing projects. Small-sized units also promote efficient use of space, making homeownership feasible in densely populated urban areas while maintaining affordability for a broader segment of society.

Participating Financial Institutions (PFIs)

To ensure smooth implementation, all major financial institutions are invited to participate in the scheme. This includes:

- All commercial banks operating in Pakistan

- Islamic banks

- Microfinance banks (MFBs)

- House Building Finance Corporation Limited (HBFCL)

The involvement of multiple financial institutions allows wider access for citizens across the country. It also ensures competitive processing of loans, helping beneficiaries secure financing quickly and efficiently. Each participating institution is responsible for ensuring proper dissemination of information about the scheme through its branch networks and other communication channels.

Loan Size, Tenor, and Pricing

The scheme provides structured loan options to suit different income levels:

| Loan Tier | Loan Amount | Customer Rate |

|---|---|---|

| Tier 1 | Up to 2 million PKR | 5% |

| Tier 2 | 2 million to 3.5 million PKR | 8% |

The maximum loan tenor under the scheme is 20 years, with a government subsidy available for the first 10 years. Banks will follow a standardized pricing formula to ensure uniformity across institutions. Additionally, no processing fees or prepayment penalties are charged, making the loans highly affordable for eligible citizens.

This structured approach ensures that both low and middle-income families can benefit from the program. Tiered pricing helps distribute financial support based on loan size, ensuring that resources are efficiently utilized without compromising the program’s sustainability.

Risk Coverage and Loan-to-Value Ratio

The government has also introduced measures to reduce financial risks for participating banks:

- Risk coverage is provided for 10% of the outstanding portfolio on a first-loss basis

- Loan-to-value (LTV) ratio is set at 90:10, meaning 90% of the home cost is financed through the loan while 10% is contributed by the customer as equity

These measures encourage banks to lend confidently under the scheme while protecting both the financial institutions and the borrowers. Risk-sharing ensures that potential defaults do not affect the sustainability of the program, and the equity contribution by borrowers fosters responsible financial behavior.

Implementation and Awareness

For successful execution, participating financial institutions are required to actively promote the scheme:

- Utilize branch networks to reach potential beneficiaries

- Conduct awareness campaigns and information sessions

- Streamline internal processes to ensure timely loan approvals

Ensuring widespread awareness is critical for the success of the scheme. Citizens must understand eligibility criteria, loan terms, and the benefits of participating in the program. Proper dissemination reduces the likelihood of misuse and ensures that the scheme reaches the intended audience effectively.

Benefits of Mera Ghar Mera Ashiana Scheme

The scheme offers multiple advantages for Pakistani citizens, including:

- Access to affordable housing without interest for 10 years

- Flexible options for purchase, construction, or plot acquisition

- Long loan tenure of up to 20 years to ease repayment burdens

- Risk coverage that protects banks and promotes confidence in lending

- Support for low and middle-income families in urban and rural areas

These benefits collectively aim to make homeownership attainable and sustainable for citizens across Pakistan. By combining financial support, risk mitigation, and structured loan plans, the government ensures that this scheme can significantly impact the housing sector and improve living standards.

Also Read: 8171 Web Portal Update September 2025 To Verify Payment Know the Government’s New Method

How to Apply for the Scheme?

Applying for the Mera Ghar Mera Ashiana Scheme is a simple and straightforward process:

- Visit a participating financial institution with your CNIC and proof of income

- Submit the application along with necessary documents, including proof of plot ownership if applicable

- The bank will verify eligibility and provide loan approval within a set timeframe

This streamlined application process ensures that citizens can access funding without unnecessary delays. Banks are encouraged to facilitate quick processing and provide guidance to applicants to make the experience smooth and user-friendly.

Conclusion

The Mera Ghar Mera Ashiana Scheme 2025 represents a transformative step toward solving Pakistan’s housing challenges. By offering interest-free loans and risk-sharing mechanisms, the scheme empowers first-time homeowners and supports the country’s economic growth. With structured loan tiers, flexible usage options, and accessible application processes, this program sets a new benchmark for affordable housing initiatives.

This initiative also highlights the government’s commitment to improving the standard of living for citizens and addressing housing shortages in both urban and rural areas. As the program unfolds, it is expected to significantly increase homeownership rates and create a positive ripple effect in the construction and real estate sectors.

Also Read: BISP Taleemi Wazaif September 2025 From 2500 To 5000 For School And College Students Of Pakistan

FAQs

What is the maximum loan amount under the scheme?

The maximum loan ranges from 2 million to 3.5 million PKR depending on the tier.

Who is eligible to apply for the scheme?

First-time homeowners holding a CNIC and not owning any house are eligible.

Can the loan be used to construct a house on an owned plot?

Yes, the scheme allows construction on an already owned plot.

Is there any processing fee or prepayment penalty?

No, the scheme waives both processing fees and prepayment penalties.

What is the loan tenure and subsidy period?

The loan tenure is 20 years, with the interest subsidy available for the first 10 years.